Small Business Loans

CEF offers loans to start or grow your business

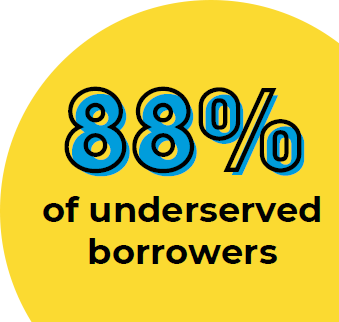

CEF provides affordable, flexible loan solutions to those not able to qualify for traditional financing

Get Started

Amount

$10k to $1,000,000

Term

3-10 Years

Interest

Fixed Rate

(Avg Rate: 9.99%)

Certified SBA 7(a) & Microloan Lender

Use of Funds

Working Capital

Machinery / Equipment

Leasehold Improvements

Business Purchase

Business Real Estate

Business Debt Collection

We provide a variety of loan solutions including options like our Community Loan Pools and VALOR for Veterans . We’ll work with you to find the right loan that fits your needs.

Key Details About Rates & Terms Get StartedMore than Just a Loan:

Business Navigation (coaching & resources)

to Empower Your Success

ONE-ON-ONE CONSULTATIONS

Our in-house navigators will help guide you throughout the life or your loan and help your business thrive.

TOPICS INCLUDE:

- Business Planning

- Sales and Marketing

- Finance and Accounting

- Cashflow and Profitability