Don't Fall for Fake UCC Forms

Don't Fall for Fake UCC Forms: A Warning for Small Business Owners

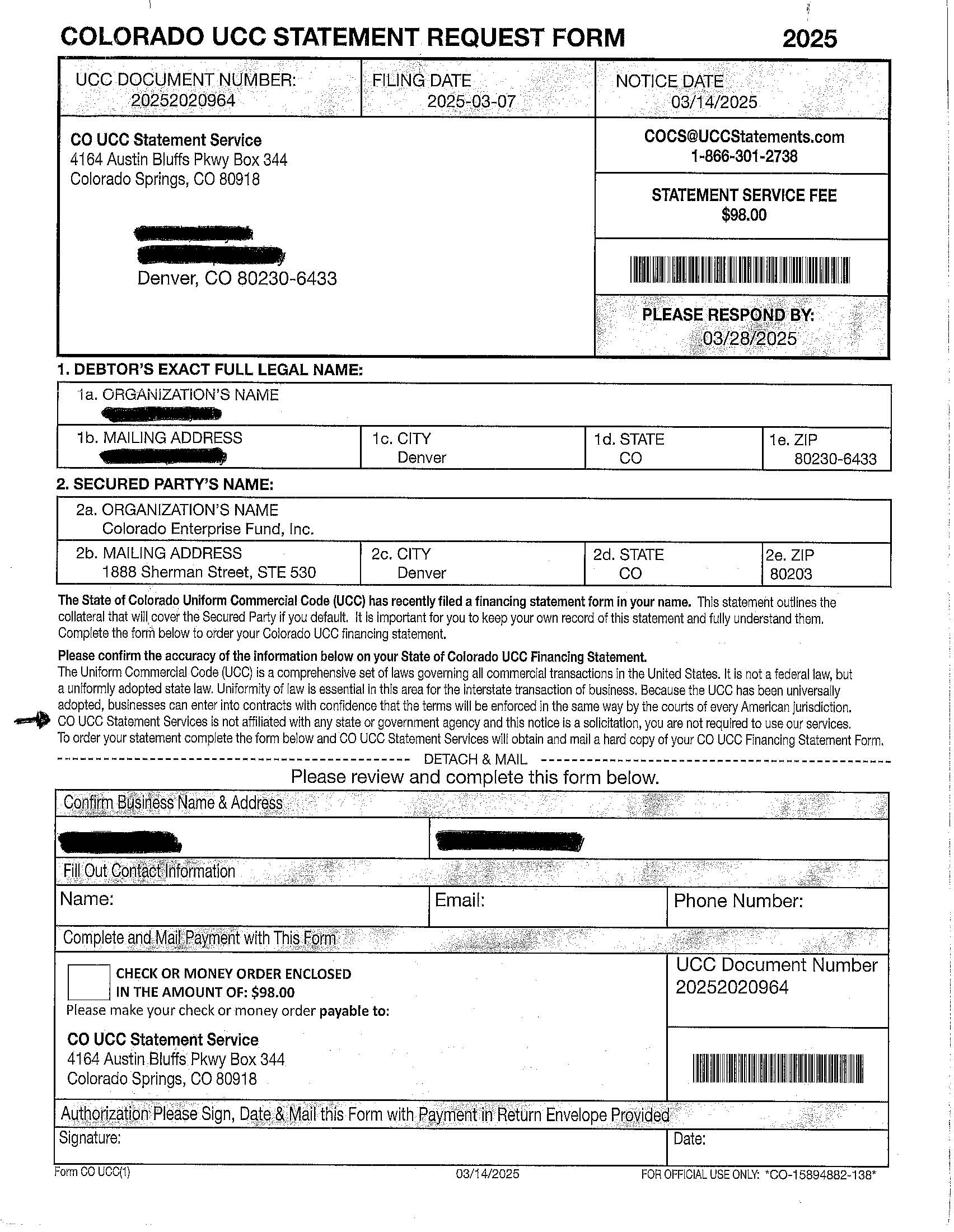

As a small business owner, you're juggling countless responsibilities—and scammers know it. They're counting on you being too busy to notice the red flags in their sophisticated schemes. One scam targeting businesses across Colorado involves fake UCC Statement Request Forms that look surprisingly legitimate.

Understanding Your Public Information

When you secure a loan for your business, certain information becomes part of the public record. Your lender files a UCC (Uniform Commercial Code) financing statement with the Colorado Secretary of State. This filing protects the lender's interest in your collateral and includes details like your business name, address, and lender information. Here is a link to the CO Secretary of State to view information available on a CO business.

Because these filings are public record, anyone can access them. Scammers regularly search these databases, harvest your information, and use it to create convincing forms that appear to come from official sources—or even from your own lender.

The Scam Revealed

These fraudulent forms arrive by mail and look official, complete with legal language and your lender's correct information. They request payment (often $95-$150) for UCC statement copies or filings you supposedly need.

Here's the catch: buried in the fine print, you'll find a disclaimer stating: "CO UCC Statement Services is not affiliated with any state or government agency and this notice is a solicitation, you are not required to use our services."

This single sentence reveals the truth—it's not an official document, it's a sales pitch designed to separate you from your money.

Protect Your Business

Read the fine print. Always examine any official-looking correspondence carefully before responding. Legitimate government agencies and lenders clearly identify themselves.

Never call numbers on suspicious forms. If you receive something questionable, look up your lender's or the government agency's contact information independently and call them directly to verify.

Question payment requests. Ask yourself: Why would I suddenly owe money for something I didn't request? Legitimate UCC filings are handled between your lender and the state—you typically don't need to pay for additional copies unless you specifically request them.

Guard your information. Be cautious about sharing personally identifiable information (PII) with anyone who contacts you unsolicited.

When in Doubt, Reach Out

If you're uncertain about any document's legitimacy, contact your lender or the Colorado Secretary of State directly. It takes just a few minutes to verify—and could save you hundreds of dollars and potential identity theft headaches.

Remember: scammers rely on confusion and urgency. By staying informed and skeptical, you protect not just your wallet, but your business's security.

See Example Below